Outsourcing to Nearshore Markets Competes with Overseas Suppliers

Nearshoring and reshoring practices have steadily gained traction in recent years, with EU- and US-based buyers investing in suppliers closer to home. Understanding these changes in supply chain trends and the global supplier market is vital to making informed decisions regarding your company’s sourcing practices.

A Growing Trend of Nearshore Sourcing

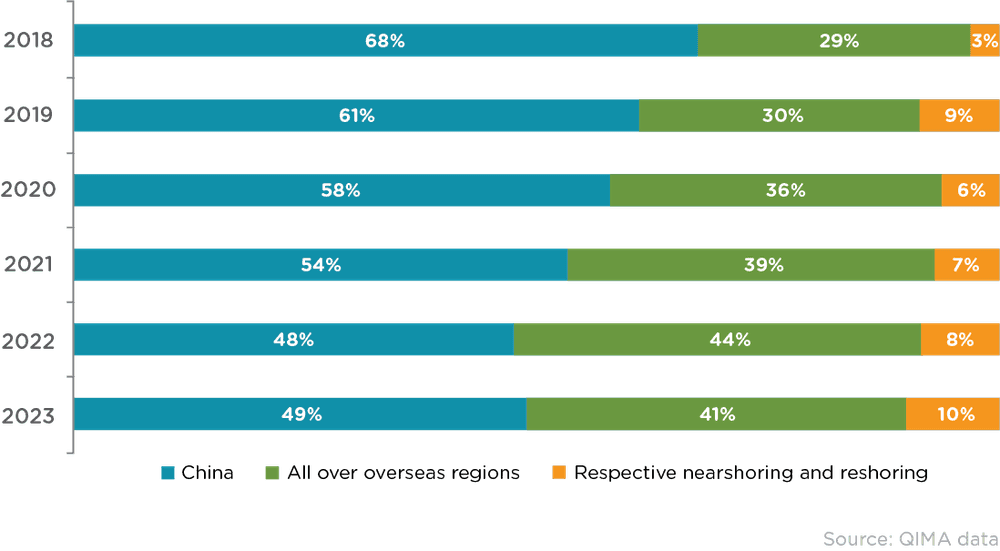

Over the past few decades, Chinese and South Asian suppliers have been the primary suppliers for US- and EU-based companies. However, QIMA’s 2023 auditing data saw a noticeable uptick in the relative share of respective nearshore and reshore regions of US and EU buyers, with these markets now accounting for 10% of their procurements.

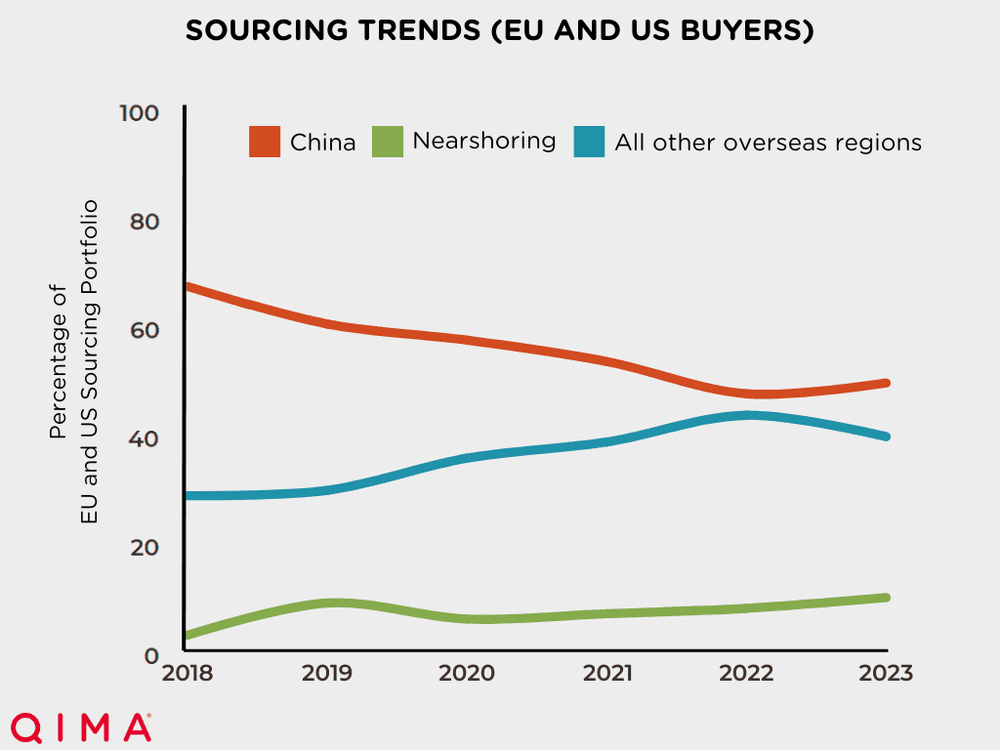

Figure 1. EU and US buyers’ sourcing trends over time. A survey of over 800 businesses revealed that EU and US buyers are beginning to decrease overseas procurement in favor of nearshoring.

Nearshoring practices have steadily increased since 2020, as EU and US buyers shift their sourcing practices away from overseas suppliers. In 2023, demands for inspections and audits in Mexico increased 16% year-on-year (YoY), surpassing China to become the US's number one trade partner.

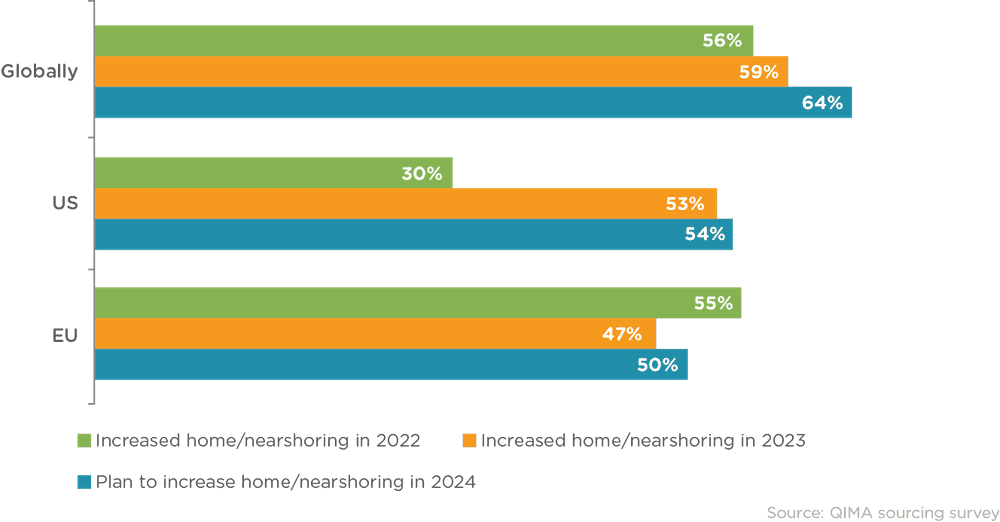

These trends are expected to continue in the coming years. A QIMA survey of over 800 businesses with international supply chains reveals that 54% of US-based and 50% of EU-based respondents plan to increase their sourcing practices from suppliers in their home and nearby regions in 2024. This survey indicates the growing investments in nearshoring and reshoring practices among US- and EU-based buyers, especially as US-Chinese geopolitical tensions rise.

Figure 2. Evolution of buyer interest in nearshoring and reshoring, 2022 - 2024, by respondent HQ location. Global markets have gradually increased their nearshoring and reshoring practices since 2022, with plans to increase further in 2024.

Nearshoring Diverts Buying Volumes from Overseas Markets

The momentum towards nearshoring and reshoring suggests a strategic shift in global markets that may impact South Asian suppliers. As interest in nearshore suppliers increased, South Asia experienced a 4% decrease in YoY procurements. Bangladesh and India, which have historically been major suppliers to EU and US buyers, also saw a deceleration of business expansions in 2023.

According to QIMA data, audit demands in all overseas regions—with the exception of China—decreased 3% YoY from 2022 to 2023, as respective nearshoring and reshoring for EU and US buyers increased 2% YoY.

This shift away from overseas suppliers may be a result of developing nations struggling to keep up with the demands of ethical compliance, which is increasingly important in maintaining ESG due diligence. Many EU- and US buyers are under regulatory demands—as well as stakeholder expectations—that push their sourcing practices to nearshore suppliers, which are typically more equipped to meet ESG compliance standards than suppliers in developing overseas nations.

Figure 3. Relative share of overseas and home regions in procurement for US- and EU-based buyers. Nearshoring and reshoring procurement for Western buyers has steadily increased since 2018, with 2023 showing a noticeable downtick in procurement from all overseas regions, with the exception of China.

As the global economic landscape evolves, the shift towards nearshoring and reshoring is reshaping the procurement strategies of Western buyers. These changes in sourcing trends likely stem from growing ESG regulations, pushing Western sourcing practices away from overseas suppliers. As businesses adapt their sourcing strategies to a changing global supply chain landscape, nearshoring and reshoring are set to play a critical role in defining the future of global sourcing.

Key Figures

QIMA’s 2023 auditing and inspection data shows:

US and EU buyers are transitioning to nearshoring and reshoring practices: A +2% YoY growth in nearshoring procurement from Western buyers from 2022 to 2023 is part of a continuing trend of shifting towards sourcing from local and neighboring regions.

Local and neighboring regions pose competition for overseas markets: Mexico surpassed China as the US's top trade partner in 2023, with a 16% increase in demand for inspections and audits.

Procurement from South Asian markets decreases as nearshoring trends rise: South Asia experienced a downturn in sourcing activities in 2023, with demand for inspections and audits reverting to 2021 sourcing levels.

Read the full report: Q1 2024 Barometer

Related Articles