Sourcing in China Is on Its Way to Pre-Pandemic Rates

While China was once the primary supplier for global supply chains, the COVID pandemic caused many companies to shift their suppliers to southeast Asia and nearshore locations. A recent QIMA survey, however, indicates that they’re shifting back to Chinese suppliers. Understanding the results of our survey and how these sourcing trends impact global supply chains can help you make informed sourcing decisions as the supplier landscape shifts.

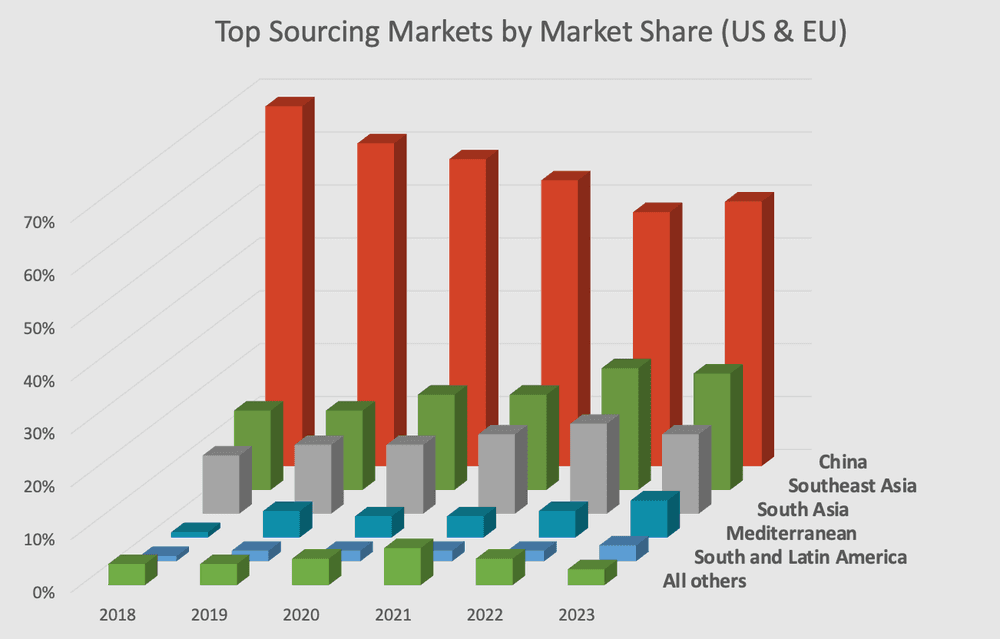

Where China once held 67% of the relative share in sourcing volumes for US- and EU-based buyers, China’s sourcing volumes fell as low as 48% in 2022. These shifts in sourcing trends came with the COVID-19 pandemic and increasing geopolitical tensions, which prompted many US- and EU-based buyers to transition their sourcing to Southeast Asian suppliers and nearshoring to reduce their supply chain risks.

However, 2023 sourcing data reveals a steady rise in sourcing from China, with data suggesting that China may be recovering from recent years’ downturns. QIMA’s data, surveyed from over 800 businesses, showed a notable increase of 5.4% year-over-year (YoY) demand for inspections and audits from US- and EU-based buyers in China.

This upward trajectory, first observed in QIMA’s Q4 2023 barometer, marks the first increase in China's share in these buyers' supplier portfolios since 2018. Such data indicates a renewed confidence in Chinese suppliers, highlighting their ability to adapt and rebound in a post-pandemic world.

Figure 1. Top supplier markets of US- and EU-based buyers (relative share in sourcing volumes) Sourcing in China has decreased yearly since 2018, while sourcing in Southeast Asia and South Asia has steadily climbed. 2023 saw the first increase in recent years of sourcing in China, with a rise from 48% to 50%.

The Future of China’s Role in Global Supply Chains

The upward shift in China’s trajectory indicates its recovery in global supply chains; however, this is not a guarantee that it will return to pre-pandemic sourcing rates. As China continues to reassert its position in global supply chains, it may have to compete with the growing markets in Southeast Asia and the growing trend of nearshoring.

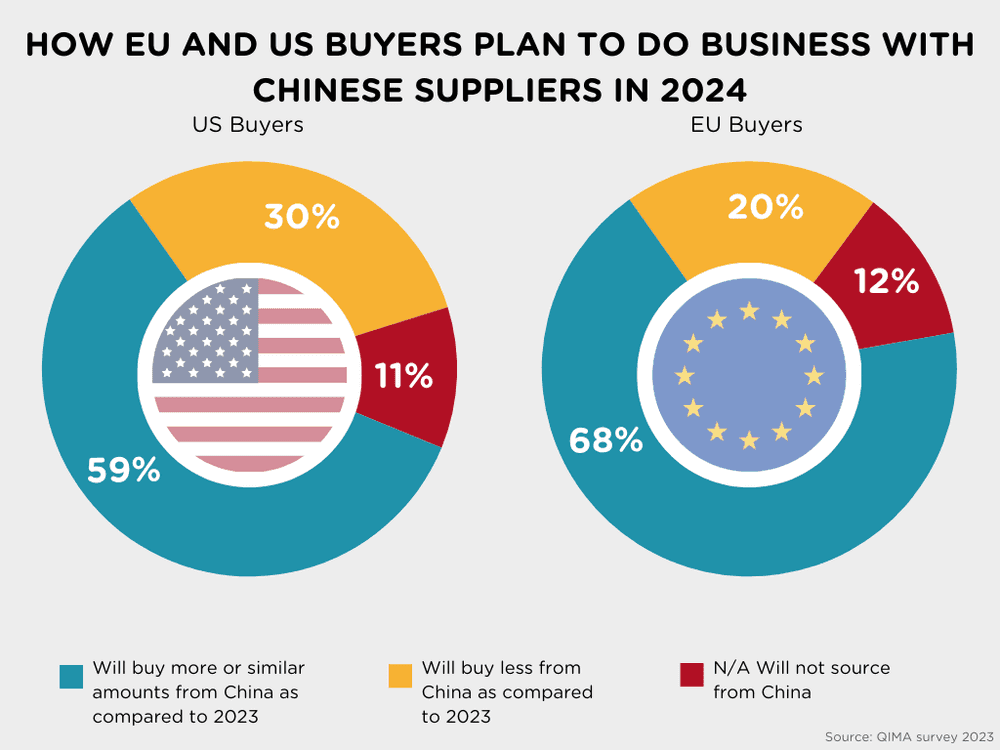

Fortunately, the optimism surrounding sourcing in China is backed by additional data showing significant interest from Western countries. According to a recent QIMA survey, 59% of US-based respondents and 68% of those headquartered in the EU plan to either maintain or increase their business volumes with Chinese suppliers. This strong interest from major global economies underscores the pivotal role of Chinese suppliers in supporting diverse and complex global supply chains, and hints at China’s recovery towards pre-pandemic sourcing rates.

Figure 2. QIMA Sourcing Survey, “How much business do you plan to do with Chinese suppliers in 2024, compared to 2023?” Surveys show that the majority of US- and EU-based buyers intend to continue or increase their purchasing habits from China, indicating the continued regrowth in Chinese sourcing from overseas buyers.

Although 2023 trends paint a promising picture for China’s recovering role in the global economy, businesses must remain cognizant of the current geopolitical landscape and its potential implications. 2024 may pose another difficult year for China-based suppliers, as the political tensions of the US presidential election could greatly impact US-China trade relationships. This geopolitical aspect could play a decisive role in shaping the future of sourcing from Chinese suppliers.

Key Figures

QIMA data reveals:

Sourcing in China is on the rise for the first time in years: China’s relative share in US- and EU-based supplier portfolios rose 5.4% YoY in 2023, showing the first uptick for the first time in five years.

Usage of Chinese sourcing will likely increase in 2024: Over half (59%) of US buyers and (68%) of EU-based buyers plan to increase or maintain current buying habits with China, while only 30% of US buyers and 20% of EU buyers intend to reduce sourcing in China.

Read the full report: Q1 2024 Barometer

Related Articles