2023 Nearshoring Trends: US Prefers Nearshoring, EU Adopts Diverse Sourcing Strategies

In 2023, the global landscape of nearshoring and reshoring strategies among major brands reveals a distinctive trend: shortening supply chains. However, US and EU buyers are taking two different approaches.

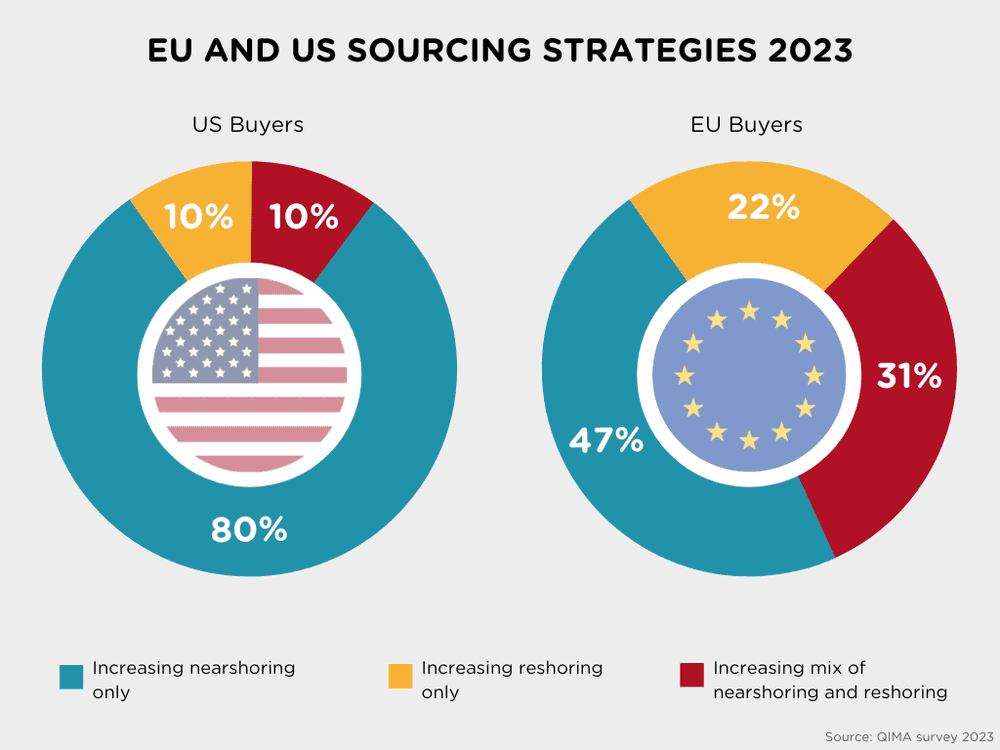

US buyers exhibit a strong preference for nearshoring, with only 20% of US buyers reporting increasing domestic sourcing in 2023. European buyers, on the other hand, are combining domestic and nearshoring sourcing, with 31% of EU buyers combining both reshoring and nearshoring strategies.

These differing strategies have important implications for US and EU buyers. US buyers prioritize nearshoring to diversify from overseas suppliers and speed up time-to-market. In contrast, European buyers' mixed approach bolsters supply chain resilience, supports local manufacturing, and takes advantage of nearby cost-effective production. These strategies are tailored to each region's response to evolving supply chain dynamics.

Sourcing Strategies in Focus: US Nearshoring vs. EU's Diverse Approach

As supply chains bring production closer to home, nearshoring and reshoring sourcing strategies are increasing worldwide. However, brands are adopting localized strategies based on their region.

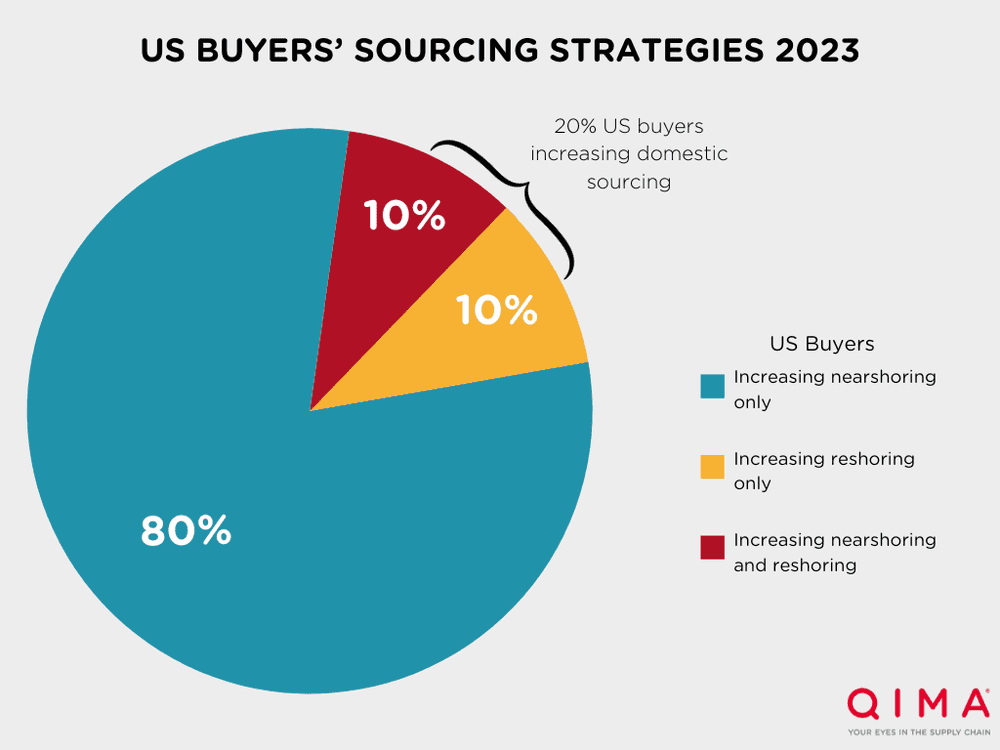

US companies view nearshoring as the preferred option to diversify from overseas suppliers and shorten time-to-market. In the last 12 months, only 20% of US buyers reported increasing domestic sourcing, while 80% of US buyers increased purchases from neighboring countries instead.

European businesses are taking a more dynamic approach by reshoring some production back home while still utilizing nearby low-cost manufacturing markets. EU buyers show immense diversity in sourcing strategies; in the last 12 months, 47% of EU buyers increased nearshoring, 22% increased reshoring (a return to domestic sourcing), and 31% preferred a mix.

European reshoring is being fueled by several factors, including a gradual shift away from China due to geopolitical tensions and an ongoing effort to enhance the EU's self-sufficiency in electronic components. As a result, there has been a significant increase in inspection and audit demand from EU buyers in both Central and Eastern European countries, along with steady growth in Western European nations like Italy, Germany, Portugal, and Spain.

However, nearshoring is still a popular strategy in the EU. There was a robust +22% year-over-year growth in inspection and audit demand from EU buyers in Mediterranean and Middle Eastern supplier markets during Q2 2023.

As global trends continue to push supply chains closer to end consumers, it will be interesting to see if these strategic differences remain between American and European firms or if a more unified approach emerges. Regardless, sourcing flexibility and proximity will likely be key supply chain priorities for both regions moving forward.

Fig. 1. “Have you started purchasing or increased your purchases from suppliers in your home country or region within the last 12 months?”

US buyers heavily favor exclusive nearshoring, while a higher percentage of EU buyers’ procuring strategies favor a mixed approach.

Key Figures

QIMA’s H1 survey of more than 250 businesses shows that:

1. US buyers prefer nearshoring to reshoring: Only 20% of US buyers reported increasing domestic sourcing in the past 12 months, preferring nearshoring to reshoring.

Fig. 2. US buyer purchasing habits in 2023: Sourcing from suppliers in the US vs. neighboring countries

2. EU buyers take a more flexible approach combining domestic and neighboring region sourcing to shorten supply chains. In 2022-2023, 31% of EU buyers favor a mix of nearshoring and reshoring.

Inspection and audit demand from EU buyers saw double-digit expansion in Central and Eastern Europe, as well as steady growth in Italy, Germany, Portugal, and Spain.

EU textile and apparel businesses still rely heavily on Mediterranean and Middle East suppliers, with 22% year-over-year audit demand growth in Q2 2023.

Read the full report: Q3 2023 Barometer

Related Articles