Changing Supply Chain Sourcing Trends: Growth in China Slowed while Southeast Asia Rises

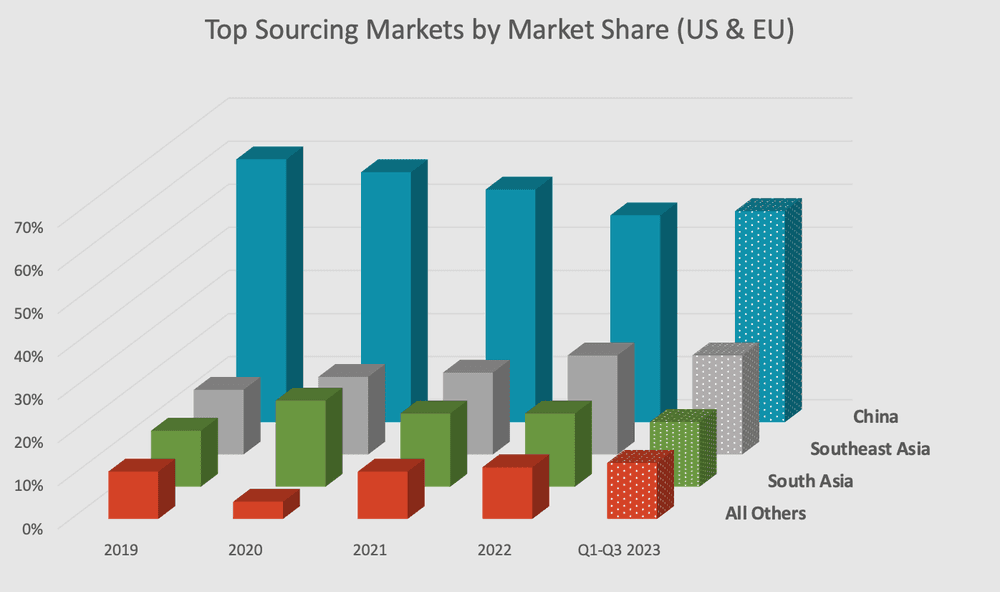

EU and US companies sourcing in Asia are increasingly turning away from China, towards Southeast Asia. In 2023, China’s share of the EU and US sourcing market dropped by 14% with Southeast Asia seeing the largest growth since 2019. This trend is expected to continue.

The shift towards Southeast Asia is expected to reshape future supply chain operations for Western companies, offering a more diverse and flexible sourcing landscape while mitigating risks associated with overreliance on a single market.

China Sourcing Remains Strong, but Growth Slows as Southeast Asia Gains Momentum Among Western Buyers

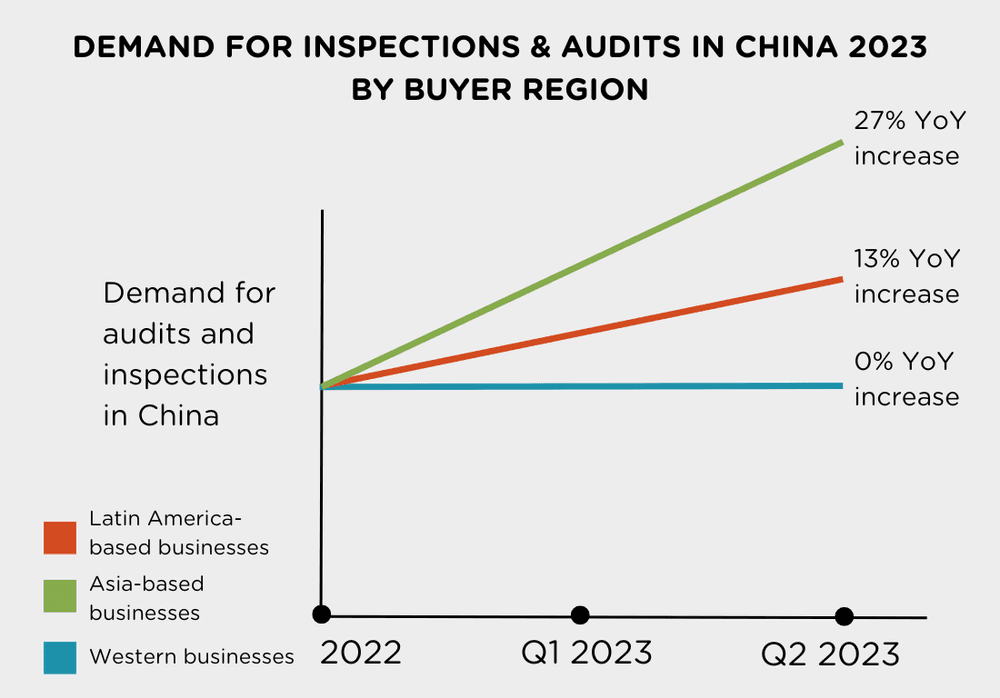

While China’s growth has slowed, demand for sourcing there is still strong. Businesses in emerging regions like Latin America and other parts of Asia are increasingly relying on Chinese suppliers. Latin American businesses’ demand for audits and inspections of Chinese suppliers grew by 13% in Q2 2023; demand from Asia-based businesses grew by 27%.

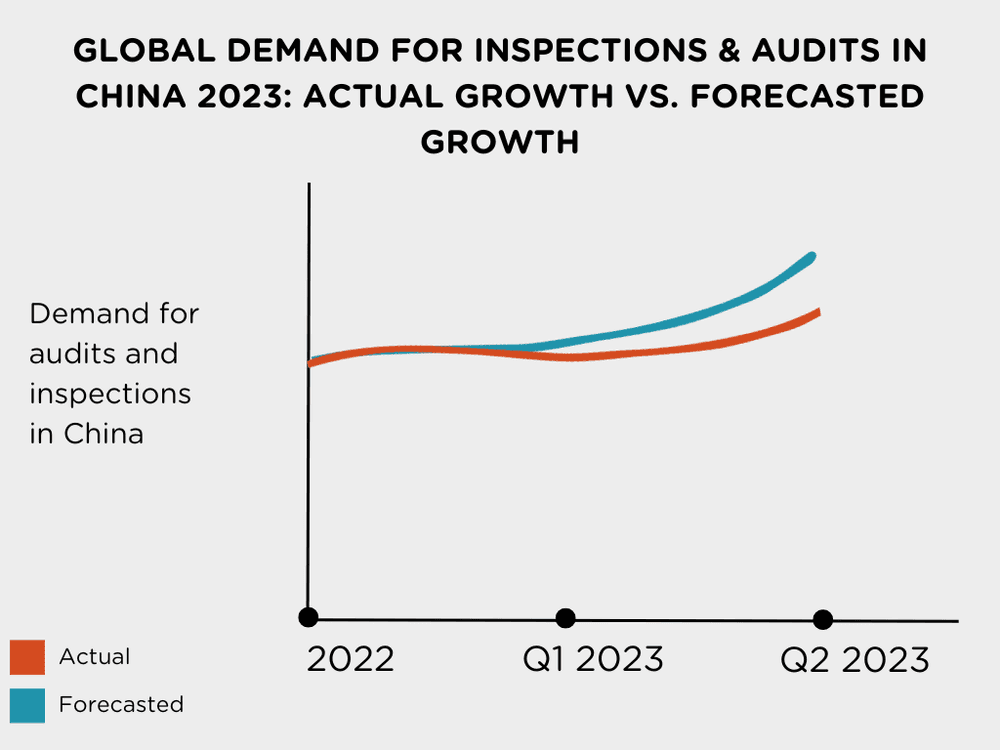

However, growth of sourcing in China is still slower than in previous years for US and EU buyers. Western sourcing in China has been growing at only 3.5%, compared to forecasts of 5.6% (a 36% lower growth rate than expected).

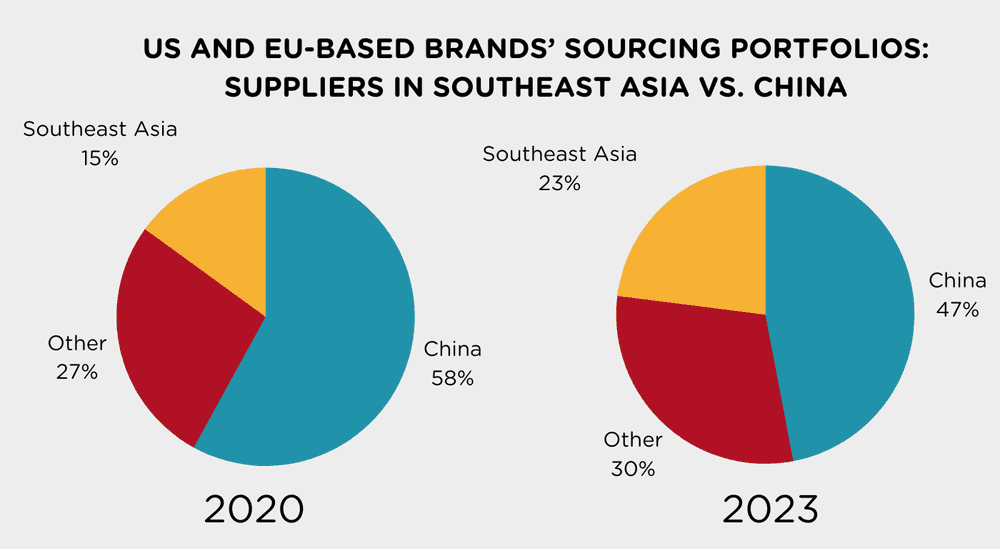

China’s slow growth can be attributed, in part, to Southeast Asia’s rising dominance as a sourcing market in the buying portfolios of US- and EU-based brands. Southeast Asia is showing promise as a rising player in supply chain sourcing, with increasing inspection and audit demand.

This shift towards Southeast Asia's ascendancy as a sourcing market holds the promise of greater diversification for Western buyers. Companies can explore a more versatile sourcing landscape, reducing the risk associated with overdependence on a single market.

As we near the holidays, QIMA’s Q4 data shows a potential shift back towards China as a key supplier for US and EU buyers in 2023. For the first time since 2019, the relative share of China in their supplier portfolios has increased. This resurgence is particularly noticeable in the Textile and Apparel sector, with a significant increase in demand for inspections and audits in China, suggesting a renewed emphasis on leveraging China's well-established manufacturing capabilities. This may be in response to concerns about the Western economy slowing down, spurring companies to turn to China as a supplier once more to make the most of its strong manufacturing capabilities.

Fig. 1. US and EU buyers’ top sourcing markets by share

EU and US sourcing in Asian countries besides China is growing, with Southeast Asia seeing the largest growth since 2019. Since 2019, China’s shares in US and EU buying portfolios have dropped by 14% as other regions become more popular sourcing destinations.

Growth rates, however, vary throughout the region. Vietnam's sourcing growth in H1 2023 lagged behind some neighboring Southeast Asian countries due to bureaucratic hurdles from an anti-graft campaign and recent power outages, with Q2 2023 data showing only a +6% YoY global expansion in inspection and audit demand for suppliers in Vietnam.

Key Figures

QIMA’s H1 2023 survey of more than 250 businesses shows that:

1. Slow growth for sourcing in China: Global demand for inspections and audits for suppliers in China increased by 3.5% year-over-year in Q2 2023, behind China's revised 2023 growth forecast of 5.6%. This shows that supply chain sourcing in China is still growing, but slowing down.

Fig. 2. Demand for sourcing in China forecasted growth versus actual growth in 2023

2. Emerging regions are the reason for supply chain sourcing growth in China: Demand for Chinese suppliers grows among Latin-American and Asian businesses, while demand for Chinese suppliers among Western businesses remains flat.

Latin America-based businesses’ demand for audits and inspections for suppliers in China increased by 13% year-over-year in Q2 2023 compared to flat demand from Western buyers in the same period.

Inspection and audit demand from Asia-based businesses for suppliers in China saw a 27% year-over-year increase in Q2 2023.

Fig. 3. Demand for sourcing in China as measured by audit and inspection orders (by buyer region)

3. US and EU buyers turn to sourcing in Southeast Asia: The combined share of Southeast Asia’s sourcing markets in the buying portfolios of US- and EU-based brands has been steadily growing, and in H1 2023 amounted to almost half of that of China (compared to one-third in 2020).

Fig. 4. US and EU-based buyer’s portfolios by sourcing region

Read the full report: Q3 2023 Barometer

Related Articles