Nearshoring in Mexico on the Rise: Mexico Overtakes China as US's Leading Trade Partner

The trend towards nearshoring is gaining momentum, with over half of US- and EU-based businesses expressing interest in working with nearby suppliers. In 2023, Mexico has emerged as the US's largest trading partner in 2023, surpassing China. In Q3 2023, US buyers’ demand for audits and inspections in Mexico showed a remarkable +17% year-over-year growth. A growing preference for nearshoring to Mexico is reshaping the landscape for US buyers, offering them enhanced supply chain reliability and agility, potentially reducing lead times and transportation costs, while promoting economic cooperation with a close neighbor.

US Buyers Prioritize Manufacturing in Mexico vs. China

Mexico has surpassed China as the US’s largest trading partner in 2023, with demand for audits and inspections seeing double-digit growth. In the meantime, the growth of sourcing in China has been slow since 2019. Only recently, in Q3 2023, did the relative share of China in US buyers’ supplier portfolios increase, representing the first increase since the start of the COVID-19 pandemic.

As of July 2023, Mexico made up 15% of US imports, while China made up 14.6%.

Mexico has been attracting new business at an impressive pace; by some estimates, Mexico’s industrial space has grown 30% since 2019. Mexico offers many benefits to US-based buyers, such as geographic proximity, zero tariffs, low labor costs, and a relatively mature manufacturing base. Buying from Mexico also allows American brands to reduce risks by shortening their supply chains.

However, like in any other region, sourcing from Mexico also presents some challenges, including infrastructure, power availability, and security.

In the coming years, US brands are likely to witness significant transformations in their sourcing strategies. As nearshoring to Mexico continues to expand, US buyers will need to address the challenges raised above to fully capitalize on the advantages that this strategic shift offers.

Read more about the history, benefits, and challenges of nearshoring in Mexico in our Whitepaper: Mexico Nearshoring for U.S. Brands: Advantages and Challenges

Nearshoring Gains Global Momentum

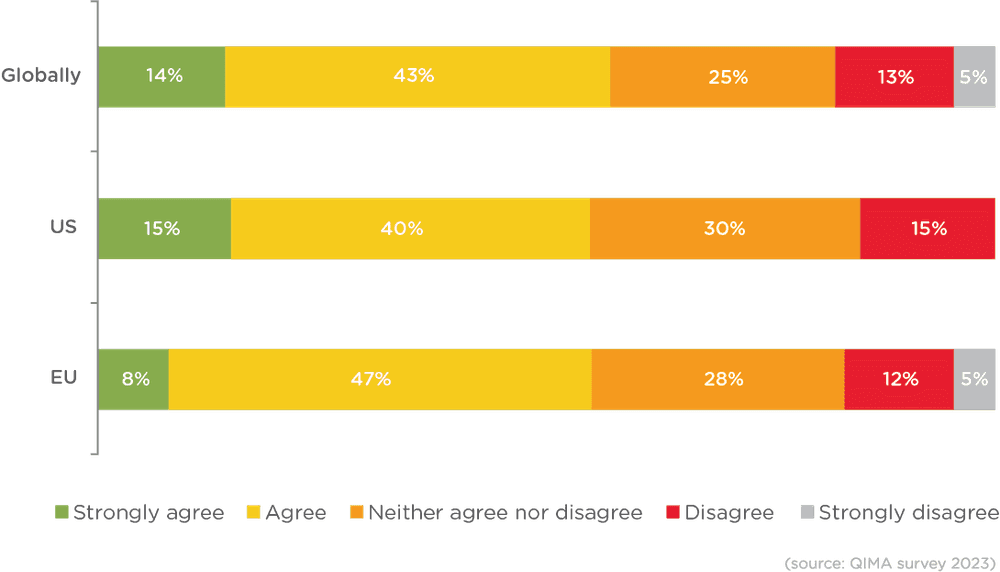

This shift to sourcing in Mexico is part of a larger global trend as more companies turn to nearshoring rather than sourcing in countries further afield. Worldwide, over half (57%) of companies QIMA surveyed reported that nearshoring is a key part of their supply chain strategy in 2023 and beyond.

Figure 1. “Is nearshoring included as part of your short and medium-term supply chain strategy?”

Companies around the world are increasingly turning away from sourcing in far-off countries and are instead turning to sourcing destinations closer to home.

Key Figures

QIMA’s survey of more than 250 businesses shows that:

Strong growth in demand for audits and inspections in Mexico: In Q3 2023, US buyers' demand for audits and inspections in Mexico exhibits a significant +17% year-over-year growth.

Impressive industrial growth: Mexico's industrial space has expanded by approximately 30% since 2019, reflecting its appeal to US-based buyers.

Nearshoring trend gains momentum: 57% of US- and EU-based businesses consider nearshoring a key element of their supply chain strategy, reflecting a broader global trend towards sourcing from nearby suppliers.

Related Articles