Best Pre-Shipment Inspection Companies

Pre-shipment inspections (PSI) are a safeguard for importers: they ensure products meet quality, packaging, and compliance requirements before leaving the factory. The World Trade Organization reported that global merchandise trade exceeded US$ 24.5 trillion in 2024, and even a 2–3% defect rate on consumer goods can translate into millions in losses for importers.

In this article, we take a close look at what each company brings to the table — and where there’s room to get even better — when it comes to pre‑shipment inspections. For every provider, we’ve pulled out the qualities that really define who they are and why they stand out as a solid option. And because no company is perfect, we’ve also flagged the challenges that matter most to people choosing an inspection partner. This isn’t a full list of every pro and con, but it’s a clear, focused snapshot designed to help you quickly size up your options.

Here is a review of the world’s most prominent pre-shipment inspection providers.

QIMA

QIMA is a tech-driven testing, inspection, and certification (TIC) company known for speed and ease of booking and one of the top 5 global PSI providers. Their platform promises inspector deployment within 48 hours and same-day reporting, and they conduct hundreds of thousands of inspections annually across 100+ countries.

Strengths

Fast turnaround: QIMA can deploy inspectors within 48 hours and deliver same-day reports, ensuring rapid decision-making for exporters and buyers.

Flexible scheduling: Inspections can be cancelled or rescheduled up to 4 p.m. China time the day before the booking at no additional cost, providing maximum convenience to suppliers and traders.

Transparent, all-inclusive pricing: Service fees cover all costs upfront, including transport, travel time, accommodation, report writing, and administrative expenses, eliminating hidden or unexpected charges.

Consistent inspection quality: Inspectors complete mandatory weekly e-learning sessions that directly impact performance bonuses, ensuring standardized results across regions.

Advanced online tools: QIMA’s digital platform enables easy online booking and tracking, interactive reporting, and access to granular analytics and data-driven insights.

Expertise across consumer goods categories: The company’s experience spans apparel, toys, electrical & electronics, furniture, and other retail products, supporting comprehensive inspection coverage.

Transparent, standards-based reporting: Inspection results are delivered using ISO 2859-1 (AQL) sampling and supported by tech-enabled dashboards for clear, data-backed decision-making.

Areas for improvement

Focused mainly on consumer goods and food, less coverage of heavy industry, medical devices

Less recognition in government-mandated PSI/PVoC schemes

Potential to scale further

Intertek

Intertek is a global TIC giant with over 1,000 laboratories and offices in 100+ countries. Beyond consumer goods, they are a well-known operator of government-mandated PSI/PVoC (Pre-Export Verification of Conformity) programs in markets such as East Africa and the Middle East.

Strengths

Recognized in PVoC and PSI programs: Global operator of government-mandated inspection schemes, with extensive experience managing Pre-Export Verification of Conformity (PVoC) and Pre-Shipment Inspection (PSI)

Widely accepted by regulators: Maintains deep relationships with national authorities and regulatory agencies in many countries

Diversified service portfolio: Spans consumer, commercial, and industrial sectors

Financial scale and resilience: Recent results show solid revenue growth, healthy margins, dividends, and a share buyback, supporting investment capacity and long-term stability for large programs.

Risk-based quality focus aligned with customer trends: Management highlights increasing client investment in risk-based quality and TQA, indicating that Intertek is positioned to capture with its AAA growth strategy.

Areas for improvement

More complex bureaucracy than digital-first providers

Report turnaround may not be as fast as QIMA or Tetra

Overextension across many sectors diluting focus

No fixed, published all-inclusive fees

Bureau Veritas

Founded in 1828, Bureau Veritas employs more than 82,000 people in 140+ countries. Their PSI focuses on quality, quantity, value, and compliance, carried out when goods are 100% finished and 80% packed.

Strengths

Structured PSI process aligned with buyer requirements: Applies standardized inspection methodologies and reporting procedures that align with international trade regulations and importing country requirements

Established credibility in trade facilitation and valuation services: Decades of experience through its BIVAC division, a partner to customs authorities and governments worldwide

Large global network: Operating in many countries, with extensive laboratory and inspection infrastructure, rapid deployment capabilities across diverse export origins and product categories.

Strong recent execution and pipeline: Under its LEAP ’28 strategy, BV delivered double-digit organic growth in 2024 with margin expansion, robust cash generation, and a completed share buyback, supporting continued investment and M&A.

Comprehensive GSIT (Government Services & International Trade) infrastructure: BV’s Verigates digital platform, inspection offices, and customs-linked IT systems support documentation flow, electronic certificates, and data sharing with national authorities.

Areas for improvement

Traditional workflows can be slower than newer digital-first competitors

Less transparent self-service booking

Limited agility in very rapid scale-up or new mandate entry

No fixed, published all-inclusive fees

SGS

SGS is the largest TIC company, with 96,000 employees and 2,700 offices worldwide. They provide PSI for consumer goods, commodities (minerals, metals, etc.), and hold exclusive mandates for PVoC in some countries, making them a prominent body for export certification in those markets.

Strengths

Broad industry coverage: Experience across both consumer and industrial sectors allows it to handle the full spectrum of goods subject to PSI, from fast-moving consumer products to bulk commodities and capital equipment.

Exclusive mandates for PVoC certification in some countries: Regulator trust and operational reliability, ability to meet national program KPIs and maintain compliance credibility

Online booking tools: Digital portals and online inspection booking simplify exporter engagement, ensure traceability, and reduce turnaround times

Comprehensive PCA / market-access know-how: Global Product Conformity Assessment framework gives regulators ready-made procedures, templates, and technical databases to manage PVoC/PSI programs efficiently

Robust financial firepower: Solid financial results (record 2024 revenues, strong cash generation, and ongoing M&A) guarantee long-term operational stability

Areas for improvement

High pricing

Bureaucratic processes less suited for SMEs

Long lead times and rigid protocols that are not very customizable

No fixed, published all-inclusive fees

Cotecna

Headquartered in Geneva, Cotecna operates in over 100 countries and conducts PSI for both consumer products and cargo. Their CPS unit specializes in retail and safety compliance.

Strengths

Strong in consumer and retail supply chains: Comprehensive inspection, testing, and certification services tailored to global retail and consumer-goods brands

Inspections across all key logistics points: At manufacturing sites, storage facilities, and ports of loading, enabling full supply-chain visibility and control over both quantity and quality prior to export

Active in trade security programs: Participates in and supports international trade-security initiatives, including customs modernization, cargo-scanning, and Authorized Economic Operator (AEO) programs

Mature digital workflow & authenticity checks: Exporters can apply, track, and retrieve documents through Cotecna’s Customer Portal, while authorities/buyers can verify certificates online via E-Dox, reducing fraud and speeding clearance.

Integrated ports & borders solutions: Capability to support customs with technology (scanner integration, risk tools) and procedures at border posts/ports

Areas for improvement

Smaller global brand compared to SGS or Intertek

May lack same-day reporting speed

Regional concentration and high reliance on partners

Limited exposure to high-margin testing, certification, and assurance markets

No fixed, published all-inclusive fees

DEKRA

DEKRA is a German firm founded in 1925, employing over 48,000 people in 60+ countries. They provide PSI for consumer and industrial products.

Strengths

Strong in industrial/vendor audits: Reliable verification of exporters and manufacturers participating in PSI programs

Flexible inspection options: Adaptable inspection solutions allowing clients and regulators to choose the right inspection point based on product risk, volume, and buyer requirements.

Trusted in engineering-heavy sectors: Expertise in industrial equipment, automotive, energy, and manufacturing, recognized for technical rigor and precision

Consumer-goods domain depth: Dedicated services for consumer goods manufacturers and supply-chain companies, useful for PSI programs that cover diverse softlines/hardlines and electronics

First Wi-Fi 7 Authorized Test Laboratory in Europe & Asia: Cutting-edge lab capability, valuable where PSI intersects with smart/IoT goods needing standards compliance evidence

Areas for improvement

Not sufficiently consumer-centric

Limited role in government PVoC programs

Limited ability to offer same-day inspection or field presence in some key export hubs across Africa, Latin America, and the Middle East

No fixed, published all-inclusive fees

TÜV SÜD

TÜV SÜD was founded in 1866 in Germany and now employs 25,000 people in 1,000+ locations. Their PSI follows ISO 2859-1 sampling, with options for post-shipment checks.

Strengths

Strong Global Market Access (GMA) expertise: Maintains comprehensive market-access knowledge (e.g., SABER, IECEE, GCC, CE), helping exporters align PSI findings and test data with destination-country requirements

Strong presence in industrial and engineering sectors: Deep roots in machinery, automotive, and electrical/electronic products allow it to handle complex, high-value shipments that require technical precision, areas where traditional PSI operators may have less domain depth.

Widely accepted test data via IECEE CB Scheme participation: As both CBTL and NCB, TÜV SÜD’s reports and certificates are broadly recognized, which smooths acceptance of supporting evidence attached to PSI/PVoC files.

Expertise in risk-based and supply-chain security standards: The company’s work in ISO 28000 (Supply Chain Security) and related audits equips it to integrate risk-based inspection principles, increasingly favored in modern PSI/PVoC program designs.

Areas for improvement

Traditional processes, less digital convenience

Not speed-focused

Limited presence in government-mandated PSI/PVoC programs

No fixed, published all-inclusive fees

TÜV Rheinland

TÜV Rheinland employs about 20,000 people in 60 countries. They specialize in industrial/commercial PSI and are active participants in PVoC and export certification programs.

Strengths

Strong in industrial equipment inspections: Their PSI offerings also target industrial equipment, components, and machinery, not just consumer goods. Deep engineering expertise.

Recognized technical authority with a strong compliance culture: technical rigor, traceability, and impartiality is one of their greatest assets.

Trusted in government inspection schemes: Credibility in executing government-mandated inspections and compliance audits

Solid global presence: Operations in more than 60 countries and a network of qualified inspectors and laboratories. Strong local coverage in major export and manufacturing hubs.

Visual & non-destructive inspection skills: They provide visual inspection and non-destructive testing (NDT) capabilities, useful for PSI of structural, welded, or mechanically sensitive components.

Areas for improvement

Less focused on consumer goods inspections

More formal, slower processes

Lacks the fully integrated e-certificate, real-time booking, and customs-linked IT platforms

Limited participation in government-mandated PSI/PVoC programs

No fixed, published all-inclusive fees

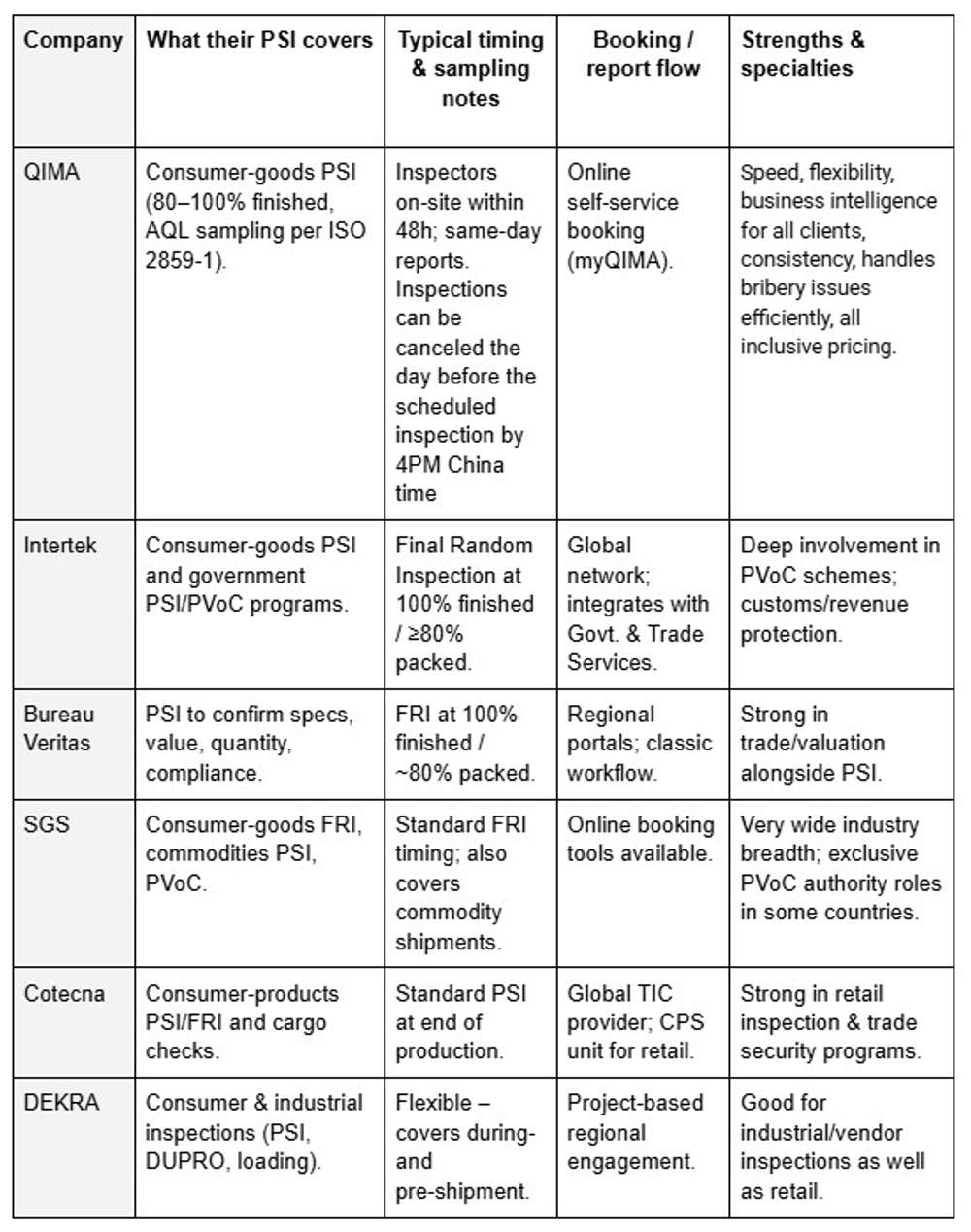

Here’s a table with a quick comparison of the pre-shipment inspection (PSI) services, covering scope, timing, booking/reporting process, and notable specialties.

QIMA Benefits

Fast Response Times: Inspectors available onsite within 48 hours of your request, with same-day comprehensive reports to support faster decisions.

Unparalleled Expertise: Specialists with in-depth knowledge of local regulations, continually trained to deliver precise evaluations and actionable recommendations.

Proven Industry Experience: Trusted by global businesses of every size to safeguard compliance and maintain quality standards.

Comprehensive Online Platform: A smart quality management system that makes it simple to schedule inspections, monitor results, and retrieve reports anytime.

Proactive Approach: Inspections built to detect and address risks early, ensuring product integrity and protecting your brand.

Global Coverage: Operating in 100+ countries, QIMA supports the consumer products, food & agri commodities, and life sciences sectors.

Contact QIMA todayto plan your pre-shipment inspection and deliver quality every time.

Related Articles