EU Action on Sustainability Sets the Tone for the Global Community

The world is currently experiencing an unprecedented pace of change, with sustainability and environmental issues at the forefront of global concerns. April has been a crucial month for the European Union (EU), with important developments and proposed legislation that will have significant consequences for businesses and individuals alike.

The EU's Commitment to Corporate Responsibility

With the CSRD just around the corner, all eyes are on the next piece of legislation, the CSDDD (Corporate Sustainability Due Diligence Directive), which requires companies to identify, prevent, and mitigate the negative impact of their own and their business partners' activities on human rights and the environment.

The EU Parliament's Legal Committee (EP JURI Committee) decided on the CSDDD on April 25th. The plenary vote is scheduled for June 1st, followed by negotiations with the Council on the legislation's final language. The requirements will then take 3 to 4 years to take effect.

Climate Change Action at the Border: The EU Bans Deforestation-Linked Products

The EU Parliament adopted the EU Deforestation Regulation (EUDR) on April 19th, with the goal of restricting the sale of products in the EU market that are linked to deforestation or forest degradation. The revised regulation now encompasses more commodities and derivative goods and emphasizes the importance of respecting human rights and the rights of affected indigenous people. Cattle, cocoa, coffee, palm oil, soy, timber, and rubber are among the commodities targeted, as are items created with or fed with these commodities. Before becoming effective, the EUDR must still be negotiated and adopted by the Council. Following that, operators and traders will have 18 months to apply the new laws, with exceptions for micro and small businesses.

To support implementation, the EU has also introduced EUDR Country Risk Rankings, which classify sourcing countries as low, standard, or high risk for deforestation. These rankings influence the level of due diligence required for products placed on the EU market.

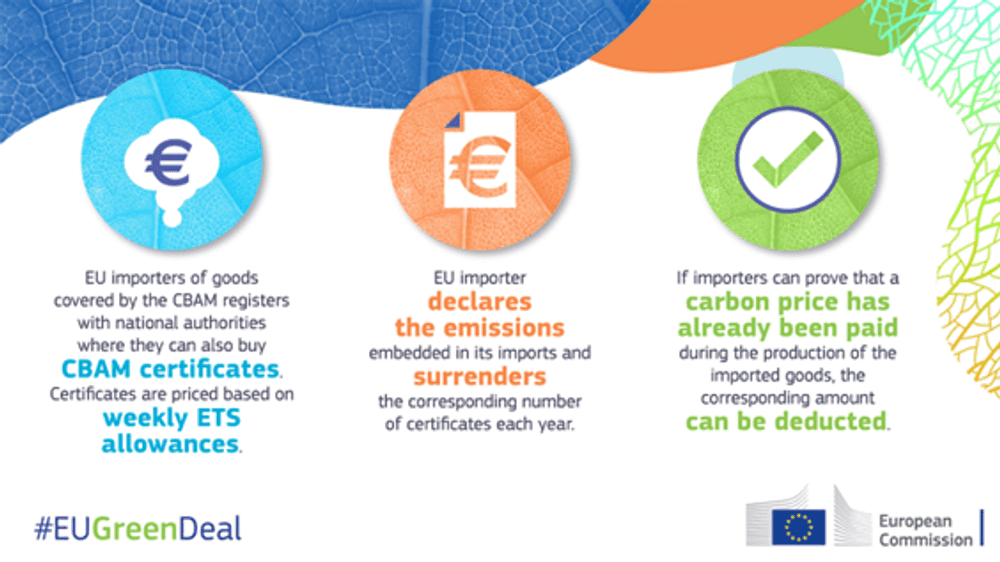

On April 25th, the Council adopted two carbon tax laws as part of the EU's "Fit for 55" package. These legislation would update the EU Emissions Trading System (ETS) by raising the aim for emission reductions, notably in the maritime sector, and phase out free allowances. The Carbon Border Adjustment Mechanism (CBAM) will also be implemented to combat "carbon leakage," the practice of shifting carbon-intensive production out of the EU and into countries with less stringent climate regulations. Companies importing goods into the EU will be required to obtain CBAM certifications, which will encourage cleaner production in non-EU nations while balancing the carbon price of local industry.

The CBAM certificates that will be purchased are connected to the embedded emissions in imported goods, which will incentivize importers to calculate the carbon product footprint accurately and reduce it over time.

The US and the UK are on high alert: the EU is setting the standard for ESG standards

Currently, the United States and the United Kingdom are keeping a careful eye on the EU's leadership in Environmental, Social, and Governance (ESG) norms. The Securities and Exchange Commission (SEC) in the United States is awaiting the final Climate Ruling, which was scheduled for April but may be delayed. Concerns have been expressed in the United Kingdom about slipping behind the EU in ESG requirements. Meanwhile, the United States' Federal Trade Commission (FTC) is examining its Green Guides.

Compliance is Critical: Businesses Must Plan for Future Legislation

Businesses must take the necessary steps to assure compliance with impending legislation as the globe faces the effects of decades of environmental negligence. The time for preparation is now, from mapping key requirements to appraising content subjects. Failure to comply with sustainability standards will not only result in regulatory penalties, but will also have a significant impact on our planet's future. Companies must act quickly to emphasize sustainability and prepare for future issues.

Download our whitepaper on Mandatory Human Rights & Environmental Due Diligence: How to Get Prepared to learn more.

Related Articles